LaMedichi is now Savings Collaborative. More services and more opportunity with the same focus on community.

English

A complete model for saving money and building the habit of savings

Savings Collaborative is more than just an app. It is an innovative savings model with a constellation of savings tools, access to loans, financial coaching, and incentives to make saving money easy and accessible.

Technology

>

A multilingual savings club app powers the savings club

Community

>

Local ambassadors build trusting relationships and provide savings coaching

Education

>

Save as you develop financial skills using our interactive tools

Technology

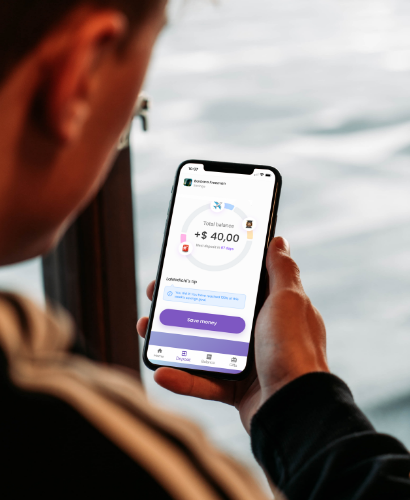

Savings made easy

The multilingual Savings Collaborative savings club app provides a friendly, easy-to-use interface that makes saving intuitive and fun. Savers benefit from built-in tools and monetary incentives to grow their savings — and financial know-how — little by little.

Savings tools to spur success

Savings Collaborative’s evidence-informed savings tools help members rapidly evaluate their budget, set and prioritize their savings goals, and make an actionable plan to achieve them. We provide real-time tips to guide action, visualize progress, and build on success.

Microloans for emergencies

In the savings club app, savings and credit work together. Members have access to emergency microloans — up to double the amount of their savings. This is an important benefit to individuals who are working to establish a safety net for themselves and financial well-being for their families.

BACK TO TOP

Community

Local community ambassadors are the heart — and the magic — of Savings Collaborative

Ambassadors build relationships with members, make saving money more accessible and financial management less intimidating. They become trusted partners in the savings journey.

Personalized savings coaching

Savings Collaborative ambassadors work with members in English and Spanish, to welcome people onboard, help them set and achieve financial goals, and provide personalized savings coaching and support. Ambassadors come from the communities they serve. The team takes pride in listening for understanding, showing empathy, and acknowledging the needs of our members.

A bridge to wealth-building

Our mission is to ensure families have access to affordable capital to build wealth for future generations. Ambassadors help people reach longer-term goals by connecting them to banks, credit unions, and professional financial counseling. These connections also provide access to asset-building loans — for cars, small businesses, and mortgages.

"From a financial institution’s perspective, the hands on learning opportunities provided by the Savings Collaborative results in a win-win situation by both strengthening the community and providing economic opportunities for its clients.

Another way of looking at the Collaborative’s work, is they are working to build financially savvy future customers, which benefits both banks and society.”

- James Wareham-Morris, Senior Vice President, Risk Management, Alpine Bank

Reminiscent of an earlier time

We are often told that the Savings Collaborative experience is reminiscent of a time when children opened savings accounts with their parents at a local bank. Each deposit and withdrawal would be recorded in a little blue book with gold letters on the front that said “Passbook.” We often hear how this experience has shaped how people think about money and save throughout their lives.

BACK TO TOP

Education

Closing the intention-action gap

What sets Savings Collaborative’s education apart from all other financial literacy programs is that members are actually saving money in the savings club app as they develop financial skills. Members gain confidence in their money management decisions as they see their real-world savings grow. This learning-by-doing approach fosters deep learning and changes behavior by closing the intention-action gap.

“

I went from, ‘I want to save,’ to

‘I am successfully saving money!’”

– Savings Collaborative Member

Professional & personalized financial counseling for all

Achieving financial well-being is not easy, especially for families who have low or limited incomes. Savings Collaborative offers in-house, professional, and personalized financial counseling for members seeking more intensive support. Our counselors are certified by the National Association of Certified Credit Counselors (NACCC).

coaching@savingscollaborative.org

Savings workshops for the whole family

Educational workshops are designed for children, adults, and the whole family. While the savings club app is used by parents, our workshops help members of all ages develop essential financial management skills — focusing on savings, spending, goal setting, and budgeting. Savings Collaborative Financial Health Institute- trained ambassadors provide savings workshops in Spanish, English, and bilingual — in-person and via Zoom.

BACK TO TOP

Sign up for our Newsletter

Stay in touch and hear from Savings Collaborative members and leaders. Be the first to know about our community programs, new incentives, and more.

The Savings Collaborative is a 501(c)(3) nonprofit organization in good standing.

Our Federal ID number is 85-4176243.

Main office

1002 Cooper Ave, Suite 100 Glenwood Springs, CO 81601

+1 970-704-6736

Denver office

3700 Tennyson St., #12525 Denver, CO 80212

+1 303-285-2553

Contact

General Inquires: info@savingscollaborative.org

Financial Coaching Services: coaching@savingscollaborative.org

All money is FDIC insured and federally backed.

©2025 SAVINGS COLLABORATIVE. ALL RIGHTS RESERVED.